Global Wealth Management Platform Market size was US$ 33 Bn in 2023 and is expected to reach US$ 76.2 Bn 2030, at a CAGR of 12.7% during forecast period.

Wealth Management Platform Market Overview:

Wealth Management Platform Market Research Reports provide qualitative and quantitative insights into key market development determinants, limitations, opportunities, and issues from a global Wealth Management Platform market. The research is based on forecasts from major organizations as well as market statistics. Sales growth figures at several regional and national market levels, as well as a competitive climate for predicted periods and individual firm valuations, are all included in market research. The Wealth Management Platform Market Report provides growth variables, current market share, various types, technologies, applications, and regional penetrations by 2029 during the forecast period.

Market Scope:

The Global Wealth Management Platform Report provides a comprehensive analysis of the market, covering data on several factors such as constraints, opportunities, drivers, and threats. The report provides the most up-to-date research on the current global market development plan, as well as the pre- and post-Covid-19 scenarios. It also provides a comprehensive analysis of the market's size based on end-user applications, products, kinds, trends, and major geographic areas.

Drivers:

Major restraints and drivers that affect the Wealth Management Platform market have also been covered in the Wealth Management Platform market report.

Details on this market,request for methodology here @ : https://www.maximizemarketresearch.com/request-sample/63945/

Segmentation:

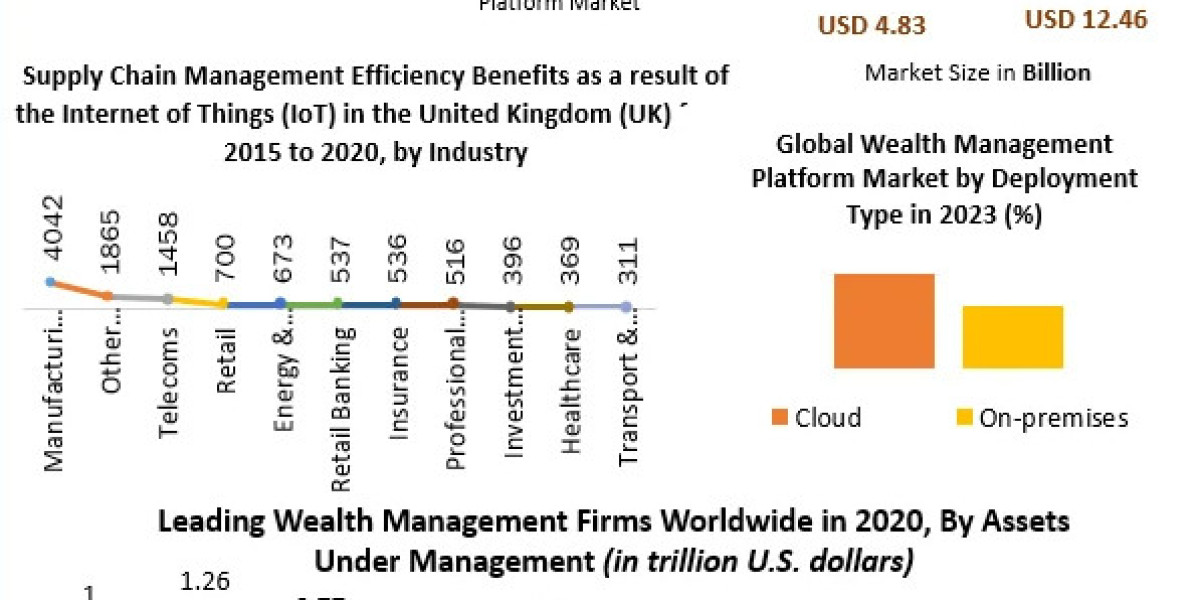

by Deployment Type

Cloud

On-premises

by Advisory Model

Human Advisory

Robo-Advisory

Hybrid

by Application

Performance Management

Risk and Compliance Management

Financial Advice Management

Portfolio accounting and Trading Management

Reporting

Other

by End-User

Investment Management

Firms

Trading and Exchanging firms

Banks Brokerage Firms

Other

Key Players: the key players are

Major Contributors in the Wealth Management Platform Market in North America:

1. Charles Schwab Corporation (San Francisco, California, USA)

2. Fidelity Investments (Boston, Massachusetts, USA)

3. Vanguard Group (Malvern, Pennsylvania, USA)

4. BlackRock, Inc. (New York, USA)

5. Morgan Stanley (New York, USA)

6. Merrill Lynch (New York, USA)

7. Goldman Sachs Group, Inc. (New York, USA)

8. J.P. Morgan Chase & Co. (New York, USA)

9. Wells Fargo & Company (California, USA)

10. TD Ameritrade Holding Corporation (Nebraska, USA)

11. LPL Financial Holdings Inc. (California, USA)

12. Ameriprise Financial, Inc. (Minnesota, USA)

13. Raymond James Financial, Inc. (Florida, USA)

14. SEI Investments Company (Pennsylvania, USA)

15. Northern Trust Corporation (Illinois, USA)

16. BNY Mellon Wealth Management (New York, USA)

17. Stifel Financial Corp. (Missouri, USA)

Major Leading Player in the Wealth Management Platform Market in Asia Pacific:

1. Charles Stanley Group (London, United Kingdom)

2. Deutsche Bank Wealth Management (Frankfurt, Germany)

Please Contact us on link: https://www.maximizemarketresearch.com/market-report/global-wealth-management-platform-market/63945/

Regional Analysis:

The report has assessed the global Wealth Management Platform market in the following regions:

America, North (the United States, Canada)

European Union (Germany, France, United Kingdom, Russia)

Asia-Pacific region (China, Japan, Korea, India, Southeast Asia, and Australia)

Latin America (Brazil, Argentina, Colombia)

Africa and the Middle East (Saudi Arabia, UAE, Egypt, South Africa)

The report also includes the following:

The analysis looks at how the Wealth Management Platform market is expected to grow in the future. Using Porter's five forces analysis to examine several perspectives on the Wealth Management Platform market

Analyzing the product type that is most likely to dominate the market and the regions that are most likely to see rapid growth throughout the projected period

Identify new advancements, Wealth Management Platform market shares, and the leading market players' strategies.

Key Questions answered in the Wealth Management Platform Market Report are:

Which key trends are likely to emerge in the Wealth Management Platform market in the forecast period?

What will be the Wealth Management Platform market size by 2027?

Which company had the biggest share in the Wealth Management Platform market in 2020?

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656