However, with great adventure comes a need for responsible planning, and one crucial aspect that climbers should never overlook is travel insurance.

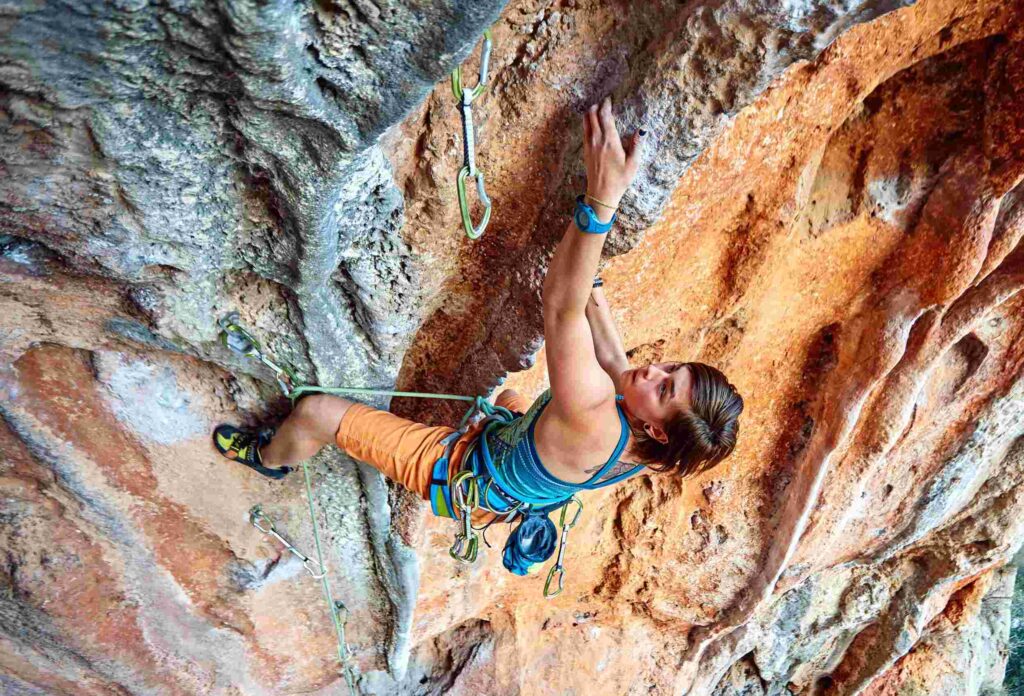

Understanding the Risks: Challenges Faced in Rock Climbing

Rock climbing is not without its risks. From unpredictable weather conditions to technical equipment failures, climbers face a range of challenges that require careful consideration. Accidents such as falls, injuries, or unexpected medical emergencies can occur, making it imperative for climbers to be adequately prepared for any unforeseen circumstances.

The Role of Travel Insurance: A Safety Net for Climbers

Coverage for Medical Emergencies

One of the primary benefits of travel insurance for rock climbing is the coverage it provides for medical emergencies. In the event of an injury, having comprehensive insurance ensures that climbers can receive prompt medical attention without the burden of exorbitant medical bills. This coverage extends to emergency medical evacuation, which is crucial in remote climbing locations.

Equipment Protection

Rock climbing involves specialized gear that can be expensive to replace. Travel insurance can offer coverage for lost, damaged, or stolen equipment, providing climbers with the financial support needed to replace essential gear and continue their adventures.

Cancellation and Interruption Protection

Unforeseen events, such as natural disasters or personal emergencies, can disrupt travel plans. Travel insurance helps mitigate financial losses by covering non-refundable expenses related to trip cancellations or interruptions, allowing climbers to reschedule their adventures without significant financial setbacks.

Choosing the Right Insurance: Key Considerations for Climbers

Adventure-Specific Coverage

When selecting travel insurance for rock climbing, it's crucial to choose a policy that explicitly covers adventure sports. Standard travel insurance may not adequately address the unique risks associated with rock climbing, so opting for specialized coverage ensures comprehensive protection.

Policy Limits and Exclusions

Climbers should carefully review policy limits and exclusions to understand the extent of coverage. Some insurance policies may have specific restrictions on altitude, types of climbing, or certain regions, so it's essential to choose a plan that aligns with the intended climbing activities.

Emergency Assistance Services

Look for insurance plans that include robust emergency assistance services. These services can be invaluable in coordinating medical evacuations, providing assistance in local languages, and offering support during critical situations.

Conclusion: Safeguarding the Climbing Experience

Rock climbing https://sportravelling.com/mountaineering/rock-climbing-insurance/ is a pursuit that demands both courage and caution. Travel insurance serves as a crucial safety net, allowing climbers to pursue their passion with confidence, knowing that they are protected against unforeseen challenges. As adventurers embark on their rock climbing journeys, investing in the right travel insurance becomes an integral part of ensuring a safe and memorable experience.